How to Build a Successful Fundraising Strategy? Pre-seed Startups

Author: Elena Obukhova, Founder & CEO at FAS

70% of startups are coming through personal connections that makes it challenging for newcomers to get access to investors.

Before we start talking about Fundraising Strategy, let’s firstly have a look at the available fundraising options.

FFF — Family Friends Fools

Many startups’ journey begins here when you pitch your great idea to your close people. Some of them cannot stay aside and willing to give you all the support they can. Normally, you won’t get big funding here, but you can get initial help that is so needed when you start with your project.

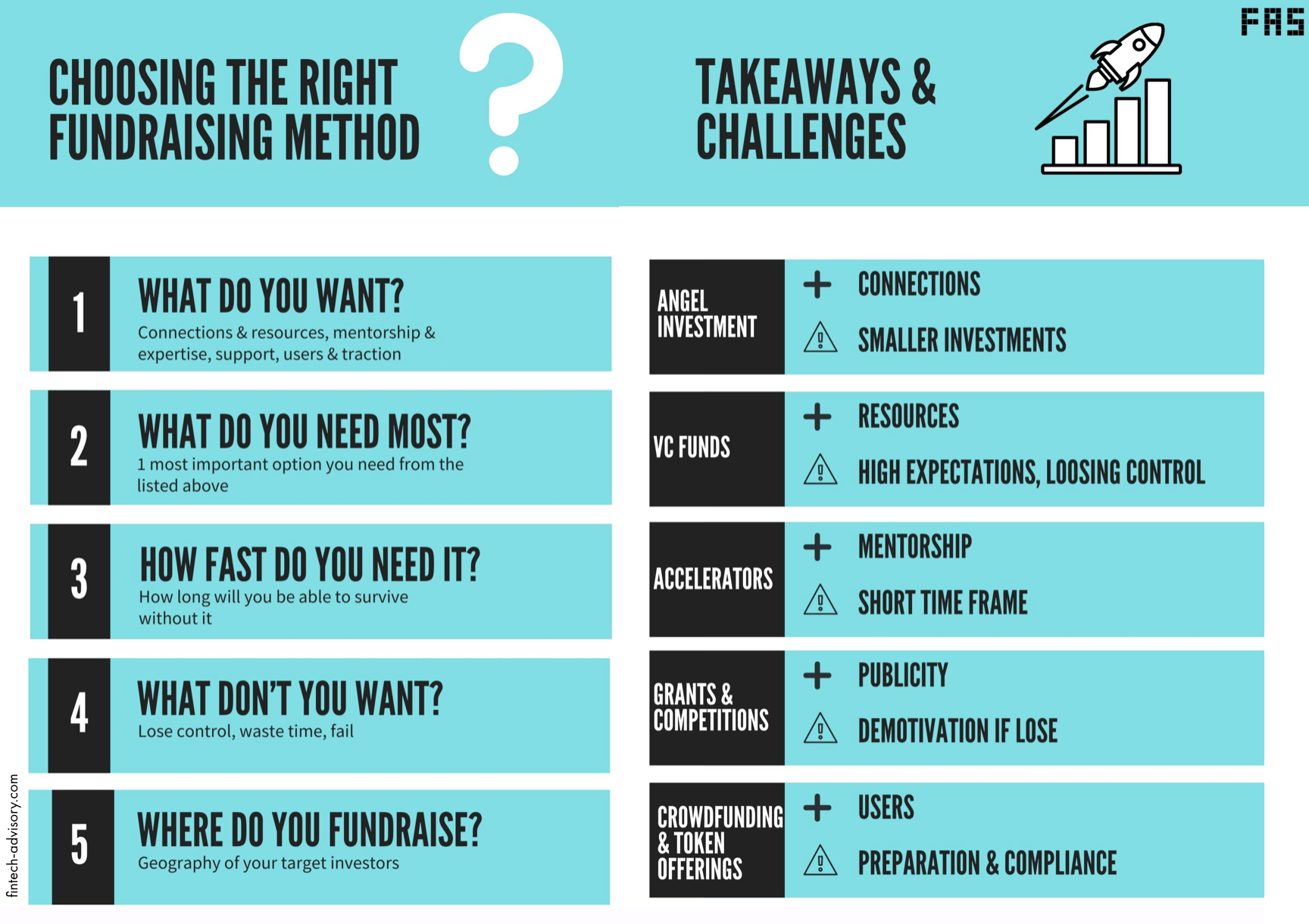

Angel Investors

When you’re at a very early stage and don’t have traction or market validation that VC funds will be asking for, one of the choices is to talk to angel investors. They won’t give you a fortune, but enough to build an MVP and do a primary product-market fitting. You can raise between U$10K — 50K, and sometimes 50K+ depends on who you talk to.

Accelerators/Incubators

Incubators are becoming less popular these days thus I would like to concentrate more on the accelerators. This option will fit you best if you’re seeking resources and mentorship together with the funding. The average investment will be US$ 50K -150K for 5–10% of the company.

VC Funds

VC funds can be divided into a few categories by size and type. There’re micro VC funds where you can come when you’re at a pre-seed or seed stage for a small raise. There’re early-stage funds that will require you to have already some traction and market validation. Some funds will require you to have an MRR of US$ 30K while you’re still at a seed stage. You would need to be more prepared here and do your homework before approaching VC funds to make sure that you’re not wasting your time.

We can also divide VC funds into traditional and corporate. Traditional VC funds usually concentrate on some specific industries, locations, business models, investment stages, while corporate funds will be looking for projects that can bring additional value to their main entity.

Grants & Competitions

If you’re eligible for any of the grant programs or competitions, that’s a good chance to challenge yourself and test the ground. Winning is great, you can add another “validation point” to your fundraising proposal. Not winning is great too as you are getting a priceless experience and feedback that can make your business only stronger. Sounds like a no-brainer! Just keep in mind that it’s only a competition where you’re not losing anything but gaining valuable insights.

Crowdfunding

Crowdfunding is a very different story and it’s your story if you’re looking to acquire more active users and investors at the same time. Fundraising gives you great exposure to the retail investors who can be potential users of your solution especially if they decide to invest. This opportunity, however, will require some initial investments. Some platforms will ask you to prepare legal documents, financials, attorney review and audit, etc. For example, you will need at least US$ 3,000 for SEC compliance (Form C) and escrow if you’re fundraising at Republic. In addition, The competition at such platforms is quite high and thus you would need some extra spendings on the marketing materials to stand out from the rest.

Token Offerings

This option is quite similar to the crowdfunding, but the crypto-friendlier target audience. During 2017–2018 the market experience a token offerings hype with thousands of the project raising money for tokens. The vast majority of these companies failed to survive and a big number of these projects never meant to survive. It started with ICOs, continued with IEOs that were popular later in 2018, and now we see a growing STO market. Each of these options has different features and goals, that I will be talking about in my next articles. In general, I would say that the goal of the token offering would be very similar to crowdfunding which is to get users and investors at the same time. People who put money in your project are most likely to stay with you longer and give a good try to your application/solution.

How to choose the right fundraising method?

I always recommend following a simple “ask yourself a question” approach. You answer a few key questions and get a better idea regarding your next steps.

1. What do you want?

There’re many things that you can get from fundraising besides the money: connections, resources, mentorship, expertise, support, users, traction, market validation, etc. Define all the things that you want to get.

2. What do you need most?

Now define what is the one thing you need most besides the money. Something that you won’t be able to build a great business without.

3. How fast do you need them?

Specify how long you can live without this thing and how soon you need to get it.

4. What don’t you want?

Understand all the deal-breakers and potential risks for your company from the fundraising. It can be the time or resources loss, can be the fear of losing control over your company. You need to understand these deal-breakers as they can stop you at the moment when/if you go in the wrong direction or will get a poor term sheet.

5. Where do you want to fundraise?

The last question will help you to structure the geography aspect of your fundraising. Whether you go with a crowdfunding campaign or a VC fund, you will need to understand where your target investors are.

Why do great projects fail to fundraise?

1. No market validation

The success of a project is not only about having a great idea. There are a few other important factors that influence the outcome of the whole journey such as team, business model, and time. You can have a very strong team with a brilliant idea, however, if you did not understand what is your market and how you are going to reach it, investors won’t take you seriously. Even though you might have figured out your business model in all the details, but if you didn’t try it out on the market yet, that would also be a difficult story to pitch. In other words, investors (especially VC funds) want to see some traction, some market validation that actually tells that your project is in for a real business and people are waiting to get your solution. The big fundraising platforms like Republic, also pay attention to market validation and traction while conducting their due-diligence and project selection. You can read in more detail about market validation and product-market fit in my other article on How to Find a Market Fit for Your Startup?.

2. Poor understanding of financials

I know many investors and startups analysts who pay a lot of attention to the numbers. I personally think one of the best ways to learn about the team (my financial background might have played a role here) is through their financials. It’s not about guessing or projecting the future, it’s about how carefully the team is trying to understand the possible scenarios of the business model, how accurately the team analyzes and budgeting their current finances. If you are to put money into the company, you want to know that you are not throwing this money into the air and you want to see that the team actually understands the value of each dollar you invest. Financials can tell about team management, controlling, planning, creative skills as well as give an understanding of how realistic the team is about the project. Financials can also tell how arrogant or not arrogant the team is. Overall, having watched lots of financial projections submitted by startups, I surely can see the difference. That’s why in many cases, financials will play a crucial role in the success of your fundraising round.

3. Unclear value proposition

This can be one of the most challenging parts of your fundraising journey. You most likely will be asked one particular question: “How hard is it to replicate your project/idea/technology?”. In other words, investors want to know what it takes for your competitor or any other company in the field to replicate what you already have and launch. You might think that if you are already out there it will be hard for potential competitors to catch up with you. However, this would be a false belief and there are many examples out on the market: Facebook to MySpace, Instagram to Fotolog, Whatsapp, and Facebook Messenger to MSN, etc. There are plenty of cases to support the point that first-mover advantage isn’t actually an advantage. In some cases, it can be a disadvantage as there is no one else from whose mistakes you can learn and you’re the one who might experience them all. Competition on the market isn’t necessarily a bad thing and in the majority of cases, moderate competition is actually a good thing that shows that this market has a demand.

You need to think about something that makes you special, which gives you a value proposition difficult to replicate.

4. Wrong team

You can have all other success factors settled, however, if your team isn’t right for this project you are unlikely to succeed. That is why it’s crucial to take the time to think about your team. To begin with, you all need to answer a few important questions:

Do I like the project?

Do I believe that the project has a chance to succeed?

Do I want to work on this project?

Can I add value?

If you and your team members can answer “Yes, I do” and “Yes, I can” to all of them then you’re on the right way. Investors want you all to be on the same page and highly motivated. They will do a background check of course and understand on their own if you have enough skills and knowledge to build the project you’re building. Nevertheless, the first thing that investors can notice, and that can drive them away is a lack of motivation or a lack of a “team”. If the team is wrong, then the project is unlikely to happen.

5. Wrong investors

And the last but not the least is pitching to the wrong investors. No matter how excellent your project is, how good your team and perfect timing are, you are not going anywhere but only losing your time if you pitch to the wrong investors. Do your homework, study VC funds/accelerators/angel investors that you are planning to talk to, and see if they invest in your industry, stage, business model, and/or location. You will save a lot of your and investors’ precious time if you know this information beforehand and reach out to only those whose criteria you meet.

KYI — Know Your Investor

Since I’ve just mentioned how important is to understand your investors, I would like to share a few questions that will help you to prepare:

* Do they invest in your filed?

* Do they invest in your business model?

* What companies did they fund before?

* Who is the main decision-maker?

* What do they pay attention to while making a decision? How likely they will like your project? [Honestly]

So now, when you have all this information, you can start setting the priorities. You should give all the first spots in your list to investors with the highest probability of investing in your project. The same would be for selecting a fundraising platform. You should put more efforts to prepare for those investors or platforms that you find a good fit for you and that you think are most likely to consider you. It will save you a lot of time and energy. It’s about investing more time in preparation and saving a lot of time during the action.